The Federal Reserve promotes the safety and soundness of financial institutions like banks and monitors their impact on the financial system as a whole.

Dodd-Frank Act

This wide-ranging legislation was signed by President Obama in 2010

Subprime Mortgage Crisis

The 2007-10 crisis stemmed in part from an expansion of mortgages to high-risk borrowers

Gramm-Leach-Bliley Act

The 1999 Act promoted financial integration by repealing parts of the Glass-Steagall Act while giving the Fed new supervisory powers

Riegle-Neal Act

The 1994 law removed many of the restrictions on bank branching across state lines

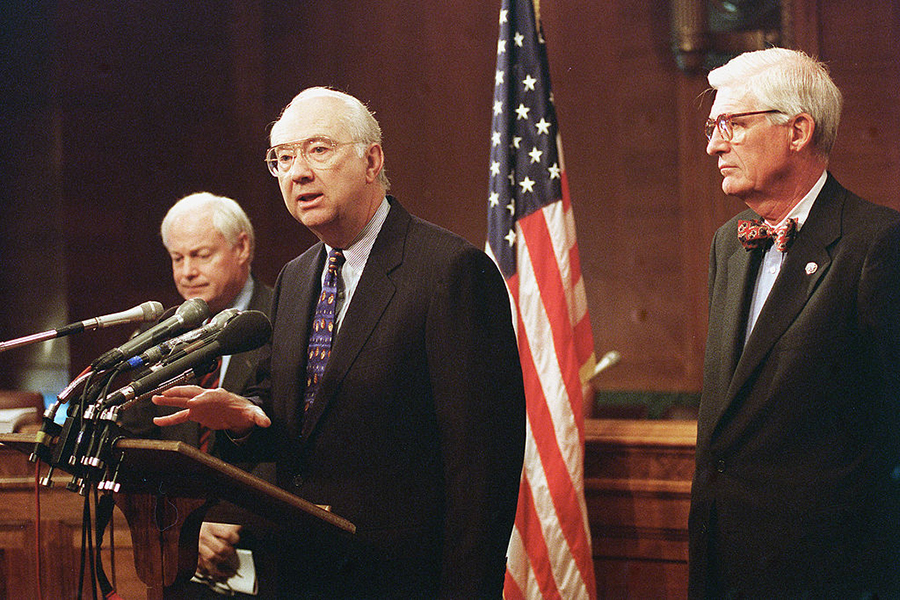

FDICIA

The 1991 Act was intended to address problems in the banking and thrift industries

Continental Illinois: A Bank That Was Too Big to Fail

The phrase “too big to fail” became commonly used for the first time after Continental’s crisis

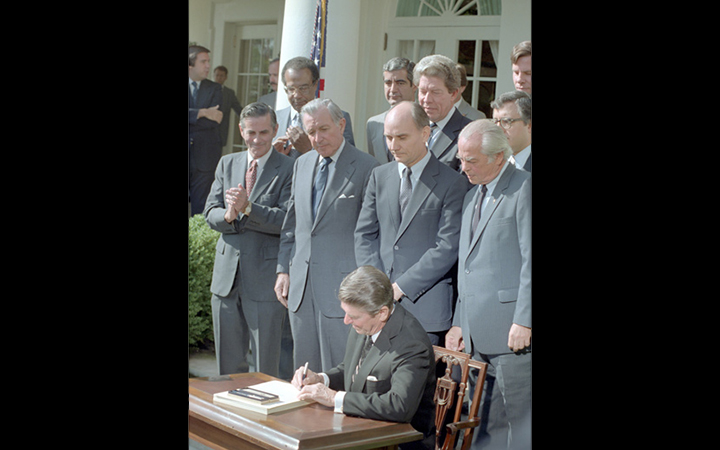

Garn-St Germain Act

The 1982 Act aimed to ease pressures on depository institutions as the Fed acted to curb inflation

Latin American Debt Crisis

During the 1980s, many Latin American countries were unable to service their foreign debt

Bank Capital Standards

A key goal of bank supervision and regulation has been to ensure that banks maintain sufficient capital.

Savings and Loan Crisis

The 1980s was a period of distress for the financial sector, especially savings and loans

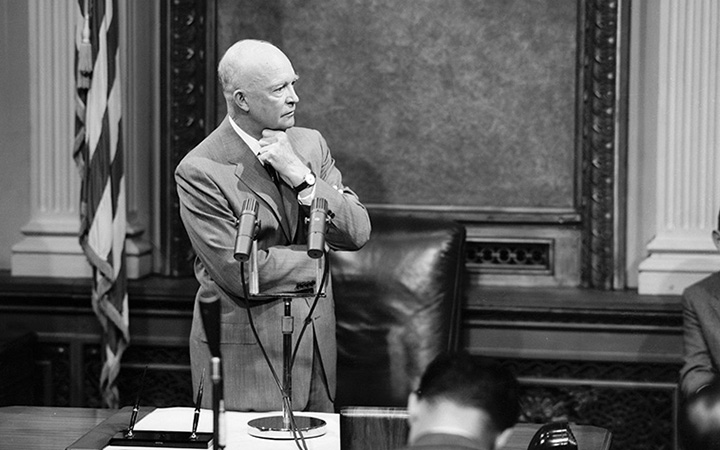

Bank Holding Company Act

In 1956, Congress gave the Fed increased oversight of the banking industry

McFadden Act

The Fed’s success led to this legislation in 1927, which rechartered the Federal Reserve Banks in perpetuity among other items