Transparency

Transparency has become a core principle of modern central banking

Historically, central bankers during the first half of the 1900s and before placed little value on transparency or public communication. "Never explain, never excuse" was a favorite maxim of Montagu Norman, the head of the Bank of England from 1920 to 1944 (Boyle 1967, p. 217). Likewise, in America: "For much of its 100-year history, the Fed was remarkably opaque," observed Gov. Jeremy Stein (Stein 2014). Central bankers valued the ability to have frank internal debates and the flexibility that closed door decision-making preserved. They also worried about outsized market impacts from disclosures.

Several factors have contributed to a greater emphasis on central bank transparency over time. The development and understanding of monetary policy has prompted scrutiny by legislators and the general public of central bank actions. Central bankers today widely acknowledge that transparency is a fundamental principle of accountability and a critical element to maintaining the independence that central banks generally have in pursuing monetary policy goals. Transparency has also increased across government in general—for example, with the passage of the Freedom of Information Act in 1967 and the Government in the Sunshine Act in 1976. More recently, central bankers have come to see public communication as a tool in the effective conduct of monetary policy. Finally, occasional adverse events, such as episodes of financial instability, have led to periodic calls for greater transparency in various functions, such as financial institution supervision and discount window lending. Overall, the Fed's transparency has increased very significantly, even as the public debate over the extent and nature of central bank transparency remains a dynamic and ongoing process (Blinder et al. 2024).

Transparency in monetary policy

When the Federal Reserve was established in 1913, monetary policy as we know it today did not yet exist. The intellectual basis for it would continue to be formed over the next few decades.1 Moreover, not until the 1951 Accord did the Federal Reserve regain the ability to make decisions independent of the Treasury. The Accord freed the Fed to use monetary policy in pursuit of macroeconomic policy objectives of price stability and maximum employment. In this environment, transparency rose in prominence in the 1950s.

Rep. Wright Patman was a leading advocate for greater transparency at the Fed. Patman made a series of requests for greater information from the Fed over many years, arguing more detailed material was necessary "to allow the Members of the House, whose duty it is to oversee the administration of the Nation's money, information vital for determining whether the Federal Reserve is carrying out the mandate of the Federal Reserve and Full Employment Act" (FOMC minutes, May 1964). Fed officials stressed that the Fed released much information through the publication of data series and analysis of the economy and that its officials testified regularly. The FOMC also disclosed its actions once per year in the Board's annual report, as required by section 10.10 of the Federal Reserve Act. However, the details of internal FOMC deliberation were largely shielded from public disclosure.

FOMC practices in the early 1960s were therefore a long way from those of today. For example, instead of issuing a statement after each of its meetings describing its policy actions, the FOMC would leave it for market participants to observe the FOMC's open market actions and infer the FOMC's intent. Changes in communication were incremental, starting with the 1967 Freedom of Information Act, the requirements of which led the FOMC to move up the timing of its disclosures to a 90-day lag after each FOMC meeting, instead of saving them for the next year's annual report. The FOMC shortened this lag to 45 days in March 1975. It shortened the lag again in May 1976 to 30 days and also expanded the contents of these releases, changes reportedly prompted by FOIA litigation that sought immediate disclosure (even though the FOMC ultimately prevailed in that litigation; see Lindsey 2003). Eventually, the FOMC came to view more rapid disclosure as making monetary policy more effective by influencing private sector expectations. This view prompted the practice of the FOMC disclosing its actions the same day of its meetings beginning in February 1994. The now-familiar practice of issuing a statement after every meeting, whether or not a change in policy had been agreed on, began with the February 2000 meeting.

Today, the FOMC also issues extensive information about the debate at its meetings. It releases meeting minutes after a few weeks that detail the discussion but do not identify individual participants and full transcripts at a lag of five years. Until 1976 the FOMC also maintained detailed internal summaries, with a level of detail somewhere in between the modern minutes and transcripts, known as the "memoranda of discussion."2 Prompted by scrutiny from Rep. Patman, the FOMC disclosed those memoranda for the first time in 1964, releasing historic memoranda up to 1960. Further disclosures came in 1967 (releasing memoranda from 1961) and in 1970 (releasing memoranda for 1962-1965), at which point the FOMC settled on a five-year lag for further disclosures of the memoranda.

Fed transparency advocates were suspicious that these memoranda omitted aspects of the discussion. They then strongly and consistently protested the FOMC's decision to stop producing the memoranda in 1976 amidst the FOIA litigation (Lindsey 2003, p. 8). Eventually, the FOMC met the demand for more information by releasing transcripts. Such transcripts had been requested in 1975 by Rep. Patman, and Chairman Burns stated that the transcripts "cannot be supplied because they are routinely disposed of" (Lindsey 2003, p. xv). However, soon afterward Fed staff apparently began accumulating transcripts, a fact that came to light in 1993 amidst inquiries by Rep. Henry B. Gonzalez and surprised even many FOMC members. Gonzalez and other critics charged that, at best, Fed officials had failed to disclose the existence of these transcripts, even amidst many general inquiries about the Fed's meeting records. At worst, critics judged the Fed "misled the public and Congress for many, many years," accusations that Greenspan found "inexplicable and distressing" (Lindsey 2003, p. 118-124).

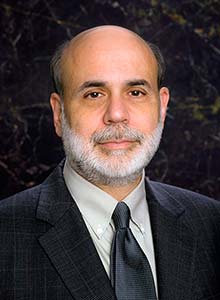

Transparency increased significantly under the chairmanship of Ben Bernanke. He viewed the Fed's transparency as more limited compared to other central banks (Bernanke 2015, p. 64). Bernanke held the first post-FOMC press conference in 2011, and under his leadership the Fed adopted an inflation target in its new statement of longer-run goals in 2012.

The turn toward significantly more transparency corresponded with changing views of monetary policy implementation. In the 1970s FOIA lawsuit, the Fed had argued that immediate disclosure of its actions "would significantly harm the Government's monetary functions," including by permitting market participants to gain unfair profits, by creating outsized price changes in financial markets, and by making open market operations more costly (Goodfriend 1985, Burns 1976). The Fed also valued how "constructive ambiguity" helped ensure liquid debt markets (Greenspan 2007, p. 151). In stark contrast, in issuing the 2012 statement on longer-run goals, the FOMC noted that communication "increases the effectiveness of monetary policy." Fed officials have come to view communication as decreasing uncertainty, allowing households and businesses to make spending and investment decisions with greater confidence (Williams 2011). For example, the FOMC began using forward guidance after the 2007-2009 financial crisis to communicate the FOMC's commitment to accommodative monetary policy and effectively ease policy further. Forward guidance has represented a major change compared with the "treasured flexibility" of the Fed during the Greenspan era (Bernanke 2015).

Transparency advocates have periodically called for even more transparency, such as FOMC meetings that are open to the public or video recorded and the more rapid release of transcripts. In releasing the memoranda and later the transcripts, Fed officials settled on a five-year lag; they have generally strongly opposed proposals for more rapid release. FOMC officials have recognized the benefits of transparency and the public and historic importance of releasing the documents; they have also sought to preserve robust internal debate.

Transparency in bank supervision and discount window lending

Periodic drives for greater transparency in bank supervision at the Fed have been motivated by episodes of financial instability. The failure of Franklin National Bank in 1974, for example, led to some scrutiny of the Federal Reserve Bank of New York's record in supervising Franklin National. Rep. Henry Reuss came to focus on the oversight of Reserve Banks by their Boards of Directors and expressed concern about potential conflicts of interest among directors with ties to Franklin National. To understand the role of Reserve Bank directors more broadly, Reuss requested the minutes of Boards of Directors meetings from all twelve Reserve Banks, records Reuss described as "important to the oversight and legislative responsibilities of the Committee." Reuss eventually received minutes for 1972, 1974, and 1975 and argued that the "secret minutes" showed several problems, including directors coordinating lobbying efforts against potential legislation and rewarding themselves lavish retirement gifts. The Federal Reserve Reform Act of 1977 enacted some of the reforms proposed following this episode, including requiring directors to have a broader variety of backgrounds, strict limits on gifts, and steps to avoid conflicts of interest.

The 2007-2009 financial crisis brought another round of intense scrutiny of the Fed's supervisory and financial stability record. In particular, the Fed's emergency discount window loans during the crisis became the subject of a FOIA request by Bloomberg News for information on individual loans. Up to that point, the Fed had published only aggregate data on the total volume of loans at each Reserve Bank. The Board of Governors argued that borrowers would experience "substantial competitive harm" if their loans were publicly disclosed because of stigma commonly associated with discount window borrowing (Board of Governors 2009; Carlson and Rose 2017). Ultimately, the court viewed this argument as too broad and speculative. As a result of the court's decision, the Board released the data in 2011. While the case was being litigated, the Dodd-Frank Act of 2010 required the Fed to disclose all discount window loans going forward at a two-year lag, a major change in the transparency of discount window lending.

A key issue in the Bloomberg News case was that the Federal Reserve Banks are not agencies for the purposes of FOIA, and are not subject to its provisions. Calls to apply FOIA to the Reserve Banks have arisen from time to time, including in reaction to pandemic-era trading activity by individual Fed officials that the Fed's Office of Inspector General found created an "appearance of a conflict of interest" and in the wake of the March 2023 banking crisis. In response to these calls, the Reserve Banks adopted a common policy in 2024 for public requests for information, known as the Transparency and Accountability Policy, described as a policy to "comply with the spirit of FOIA."

"Audit the Fed" and other proposals

Calls to "audit the Fed" or similar proposals have arisen from time to time, such as (but not limited to) those in 1952, 1975, 1989, and 2015. The phrase "audit the Fed" is misleading, since these calls typically do not refer to financial audits. In fact, the Federal Reserve System's finances are audited extensively every year. Instead, the phrase has typically been used in the sense of external reviews of the FOMC's monetary policy decisions, potentially by the Government Accountability Office (GAO, once known as the General Accounting Office). In 1978 Congress specifically excluded monetary policy from GAO review, even as it expanded the GAO's audit scope over other functions such as bank supervision, in recognition of the importance of independent monetary policy. Then-Governor Jerome Powell judged that the 2015 audit proposal was "based on the assertion that the Federal Reserve operates in secrecy and was not accountable for its actions during the crisis, a perspective that is in violent conflict with the facts" (Powell 2015).

Conclusion

Alan Greenspan observed in 1993 that "The Federal Reserve has a reputation, along with other central banks, of being secretive" (Greenspan 1993). Since the early 1990s, though, a sea change in transparency practices has occurred as officials at the Fed and other central banks have embraced transparency far more than their predecessors.

Endnotes

- 1 See Fischer (2016) for a brief overview of key contributions to the development of monetary theory in the late 19th and early 20th century by Knut Wicksell and John Maynard Keynes.

- 2 The "memoranda of discussion" were once known as the "minutes," but this essay refers to them consistently as memoranda in order to avoid confusion with the minutes that the FOMC releases today, which are not as detailed as the memoranda.

References

Bernanke, Ben S. The Courage to Act. W.W. Norton, 2015.

Blinder, Alan S., Michael Ehrmann, Jakob de Haan, and David-Jan Jansen. "Central Bank Communication with the General Public: Promise or False Hope?" Journal of Economic Literature, 62 (2) 2024: 425–57. Available online

Board of Governors of the Federal Reserve System. Memorandum of Points and Authorities In Support of Defendant's Motion of Summary Judgment. Docket 11 in Bloomberg L.P. v. Board of Governors of the Federal Reserve System, Civ. No. 08 CV 9595 (LAP), 2009. Available online

Boyle, Andrew. Montagu Norman, A Biography. Cassell, 1967.

Burns, Arthur. "The Proper Limits of Openness in Government." Address at the 1976 International Monetary Conference, San Francisco, California, June 19, 1976. Available on FRASER

Carlson, Mark and Jonathan Rose. "Stigma and the Discount Window." 2017. Available online

Federal Open Market Committee (FOMC). "Historical Minutes," May 5, 1964. Available on FRASER.

Fischer, Stanley. 2016. "Low Interest Rates." Remarks at the 40th

Annual Central Banking Seminar, Sponsored by the Federal Reserve Bank of New York, October 5, 2016. Available on FRASER

Goodfriend, Marvin. "Monetary Mystique: Secrecy and Central Banking." Federal Reserve Bank of Richmond Working Paper 85-7, 1985. Available on FRASER

Greenspan, Alan. 1993. Testimony before the Committee on Banking, Finance and Urban Affairs, U.S. House of Representatives, October 13, 1993. Available on FRASER

Greenspan, Alan. The Age of Turbulence: Adventures in a New World. Penguin Press, 2007.

Lindsey, David. "A Modern History of FOMC Communication: 1975-2002." June 24, 2003. Available on FRASER

Powell, Jerome. "'Audit the Fed' and Other Proposals." Remarks at Catholic University of America, Columbus School of Law, Washington, D.C., February 9, 2015. Available on FRASER

Stein, Jeremy. "Challenges for Monetary Policy Communication." Remarks to the Money Marketeers of New York University, New York, New York, May 6, 2014. Available on FRASER

Williams, John. "Opening the Temple." Federal Reserve Bank of San Francisco Annual Report. 2011. Available on FRASER

Published August 5, 2024. Jonathan Rose contributed to this article. Please cite this essay as: Federal Reserve History. "Transparency." August 5, 2024. See disclaimer and update policy.