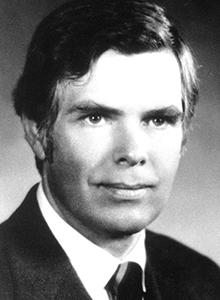

Hugh D. Galusha Jr.

- President, Federal Reserve Bank of Minneapolis, 1965–1971

Hugh D. Galusha Jr. served as the president of the Federal Reserve Bank of Minneapolis from April 15, 1965, following the resignation of Frederick Deming, until his death on January 31, 1971.

A Helena, Montana, native, Galusha was born in 1919. He attended the University of Montana, Missoula, and Carroll College, Helena, and received a bachelor’s degree from the University of Pennsylvania. He passed the bar exam in Montana.

Galusha was head of his own CPA and tax law firm for many years and was a director on the Minneapolis Fed’s board of directors when he was appointed president.

Emphasizing the Reserve Bank’s regional responsibility, Galusha held economic roundtables for Reserve Bank officers and staff, and representatives from the community. Dubbed the Baconian Dialogues, these two- to three-day sessions pulled together forty to fifty people from business, other professions, labor, and government to discuss the issues of the times. Planning for a new Minneapolis Fed Bank building, designed by Gunnar Birkerts and Associates, also began during his presidency.

Galusha, a western history buff and an authority on national parks and wilderness areas, died in January 1971, at the age of fifty-one, while on a snowmobile trip to Yellowstone National Park. Testimonials to his intelligence, wit, and understanding of the Fed’s mission appeared in many publications upon his death.

The American Banker editorial of Feb. 5, 1971, summed up one of Galusha’s strengths thusly: “He never lost sight of his primary function as a central banker, and sought to accomplish much of the work he knew needed to be done, through banking … he saw a need for small country banks to achieve greater options in their structure, so as to be able to pool resources to serve the changing needs of their communities.”

In Galusha’s own words, from a speech titled “Banks, Bankers and Change” delivered in May 1969: “The changes that are taking place in the United States have to be anticipated by banks; which is another way of saying all banks have to think about what kind of a world they’ll be functioning in at some point well out in the future. Only if they can anticipate some of the possibilities in that world can they intelligently prepare their institutions to meet the demands which will be imposed upon them by the customers of that later date.”1

Written by the Federal Reserve Bank of Minneapolis. See disclaimer.